Wildfires are an increasingly frequent threat, especially in fire-prone areas like California and other parts of the western United States. These natural disasters can destroy homes, properties, and lives in a matter of minutes. That’s why understanding wildfire insurance coverage is critical for homeowners in high-risk regions. Read on to unpack what wildfire insurance is, how it fits into homeowners insurance, additional coverage options available, and how to file a claim. We’ll also discuss practical steps you can take to protect your home, including creating defensible space and utilizing emergency tree services for fire mitigation.

What Is Wildfire Insurance?

Wildfire insurance isn’t a standalone policy you purchase separately from your homeowners insurance. Instead, wildfire coverage is typically included in standard homeowners insurance policies, although the extent of that coverage can vary.

Types Of Insurance Policies That Cover Wildfires

Wildfire damage is usually covered under the “dwelling” and “personal property” portions of a standard homeowners insurance policy. These components cover the cost to repair or rebuild your home and replace personal belongings damaged or destroyed by a fire.

Some homeowners, particularly those in high-risk areas, may need to purchase additional fire-specific coverage or policies through special markets, as traditional insurance carriers may not offer coverage due to increased risk.

Are Wildfires Covered By Homeowners Insurance?

Understanding what your homeowners insurance does and doesn’t cover when it comes to wildfires can help you make better decisions before disaster strikes.

Standard Homeowners Insurance Policies

Most standard homeowners insurance policies do include coverage for wildfire damage. This typically covers:

- Damage to the structure of your home

- Detached structures like garages or sheds

- Personal belongings

- Temporary living expenses if you’re displaced

However, insurers in wildfire-prone areas may increase premiums, impose strict underwriting guidelines, or refuse to renew policies altogether.

Exclusions And Limitations

In high-risk wildfire zones, coverage can be limited or excluded entirely. Some common limitations include:

- High deductibles for wildfire-related claims

- Caps on coverage for outbuildings or landscaping

- Refusal to insure homes without adequate fire protection measures

Homeowners who live in areas designated as very high fire hazard severity zones may be forced to seek insurance through state-run programs or specialty insurers.

Additional Insurance Options For Wildfire Protection

If your standard homeowners insurance is inadequate or doesn’t cover wildfire damage, you still have options.

Fire Insurance Riders

A fire insurance rider is an add-on to your existing homeowners policy that increases your coverage specifically for fire damage. These riders can cover gaps in your existing policy or provide enhanced protection for valuable items like artwork or electronics.

Excess And Surplus Lines Insurance

If you’re unable to get coverage through traditional carriers, you may need to look into the excess and surplus (E&S) market. These insurers specialize in high-risk properties and offer customized coverage for unique situations—including homes in wildfire zones.

Policies through the E&S market may come at a higher cost, but they often provide broader coverage where standard policies fall short.

Filing A Claim After A Wildfire

Dealing with the aftermath of a wildfire is overwhelming, but having a clear understanding of the claims process can make recovery a little easier.

Steps To Take After A Wildfire

- Document the damage: Take detailed photos and videos of your home and personal belongings.

- Contact your insurance company immediately: Report the loss as soon as possible to initiate your claim.

- Review your policy: Understand your coverage, deductibles, and any limitations.

- Secure the property: If it’s safe to do so, prevent further damage by boarding up broken windows or using tarps.

- Track expenses: Keep receipts for temporary housing, meals, and other out-of-pocket costs.

Common Challenges During The Claims Process

- Delays in processing due to high claim volumes

- Disputes over the value of property or repairs

- Denied claims due to perceived negligence (e.g., failing to create a defensible space)

- Underinsurance if coverage limits don’t reflect the true cost of rebuilding

Being proactive before disaster strikes is one of the best ways to prevent complications during the claims process.

Tips For Protecting Your Home And Finances

You can’t always control natural disasters, but there are proactive steps you can take to reduce your risk and increase your financial resilience.

Preparing For Wildfire Risks

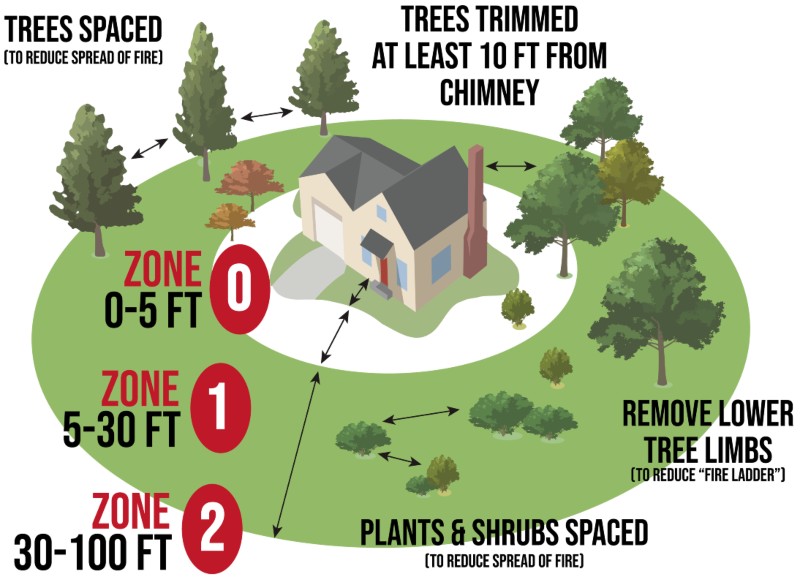

- Create defensible space around your home by clearing flammable vegetation and debris within at least 30 to 100 feet of your home.

- Remove dead or hazardous trees using professional tree removal services (link). This not only reduces fire fuel but may also help you maintain insurance eligibility.

- Invest in fire-resistant landscaping and materials for home construction.

- Schedule regular tree inspections and use emergency tree services (link) after storms or during fire season to address urgent hazards.

- Prepare an emergency kit with essentials like water, food, medications, and important documents.

Reviewing And Updating Your Insurance Coverage

- Conduct an annual insurance review to ensure your policy reflects current rebuilding costs and property value.

- Increase dwelling and personal property limits if needed.

- Consider extended replacement cost coverage, which can pay more than your policy limit if rebuilding costs exceed expectations.

- Ask about fire-specific discounts for taking preventative measures like installing fire-resistant roofing or maintaining defensible space.

Conclusion

Wildfires can be devastating, but by preparing ahead of time and staying informed about your insurance options, you’ll be better equipped to recover if disaster strikes. Create defensible space, invest in professional tree removal, and know when to call for emergency tree services to help minimize your wildfire risk!